Question on Average Daily Range

by Cliff Clark

A question was recently asked from one of the guys that I work with that I thought some others might benefit from.

Question:

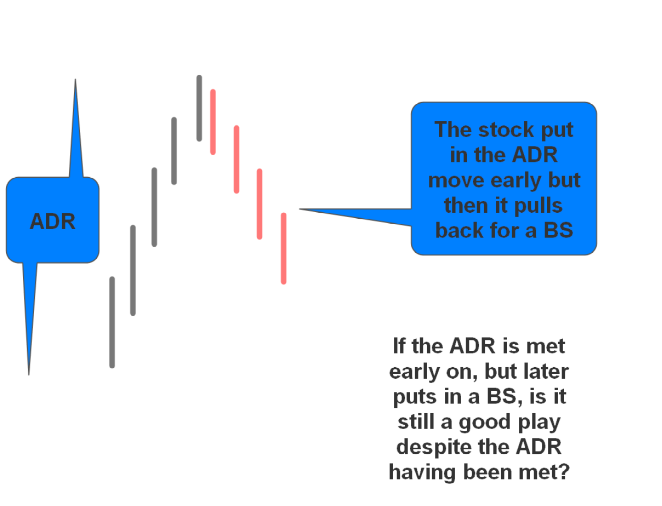

My expectation on this play would be back up to the highs, BUT is it the case where once the ADR is hit, should the stock be taken off your watch list? I realize with good gaps and high pre-market volume, stocks can far exceed their ADR, but if they do, and a pull back for a good setup happens under the high, is the setup still valid? See Chart below

My Response:

I would say it can be played depending on how it pulled back. If it was a quick rise and then a pull back of less than 50% of the run-up, I'd say it's playable. If it pulls back much farther than that I wouldn't trust it. I much prefer shallow pull backs. Although in recent months I have seen many stocks pulling back 80-90% and running back to new highs.

You can also look at the history of the stock. Has the stock had these kind of gap up and then pull backs before? If so then let the history of that stock speak for you.

In trading there really are no hard and fast rules. We must observe, track and play the percentages as best we can.

2 trades for me today with +1.5R total

1st Trade QCOM +2R

148.39/149.97 exit 143.25

12% gap down under pivot support and 50ma after a strong daily double top rejection,. I took it on a congestion breakdown with a fairly wide stop, leaving my 2R target 50c over its ATR, slow but consistent move down with great RW, hit my target on the penny before it bounced.

2nd Trade AQB -0.5R

9.40/9.70 exit 9.56

I rarely trade stocks under $10 and even more rarely short them. I liked this daily chart as it broke its uptrend channel and stayed under a strong 9.50 support line enough room to its daily 50ma. I entered after a pullback with a fairly wide stop but only 1/3 of its ATR used at the time. It failed to break down with the strong market open and stayed in a narrow range.

I actually broke my plan with this trade as I lowered my stop to a pivot where price made a big bounce earlier at 11am with a large seller sitting there. My thought was that if it breaks that level again then it will likely...

1 trade for (-1R)

I took a BD on QCOM. I was worried about the target being close to the daily range, so I took a tighter stop on the 2 min chart. I am looking through PTS right now, most of the examples have 2 options for where to put your stop. It looks to me like one of the stops would be at the bottom of the main consolidation area, and the other at the bottom of where there has been a shakeout or turnaround bar (if there has been one). Due to the daily range I took the tighter one on this. In hindsight it seems obvious to take the wider stop, but in the moment it looked ok.

I was then looking at the 15 min 3BP on QCOM, but the reason I used a tighter stop in the first place was because of the range. The 15 min 3BP would have needed to have gone even further than the wider stop on the 2 min BD, so I didn't take it.